Tax Blog

Tips to help you prepare for tax season

AICPA Renews Call for PPP Extension and Expansion

The American Institute of CPAs is adding its voice to others calling for an expansion of the Paycheck Protection Program (PPP) and seeks to extend the program’s lifespan.… Read more about AICPA Renews Call for PPP Extension and Expansion (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Drought-Stricken Farmers, Ranchers Get Tax Relief from IRS

American agriculture is in the grip of a major drought, with many farmers and ranchers forced to sell off major portions of their herds to avoid starvation.… Read more about Drought-Stricken Farmers, Ranchers Get Tax Relief from IRS (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Final Regulations for Estate and Non-Grantor Trust Deductions, 100 Percent Bonus Depreciation

Anyone who has prepared tax returns professionally knows that change is the rule, not the exception. When tax laws change, the Internal Revenue Service has the unenviable task of making sense of legislation or executive actions that directly impact the tax industry.… Read more about Final Regulations for Estate and Non-Grantor Trust Deductions, 100 Percent Bonus Depreciation (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

IRS Reminds Taxpayers About Extension Deadline

More than 150 million tax returns have been sent to the Internal Revenue Service, but many taxpayers still need to file for tax year 2019. That’s why the IRS recently reminded taxpayers that the extension deadline is less than a month away.… Read more about IRS Reminds Taxpayers About Extension Deadline (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

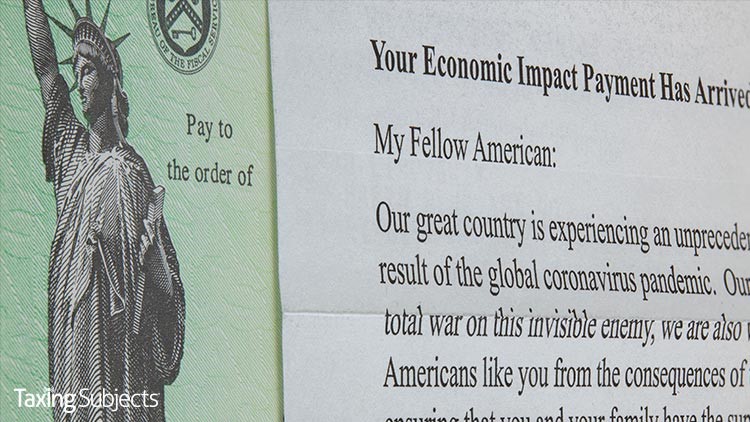

IRS Readies Nine Million Letters to Non-Filers on EIPs

Some nine million letters are being sent later this month in a special mailing to people who haven’t had a need to file a tax return but may qualify for a Economic Impact Payment (EIP).… Read more about IRS Readies Nine Million Letters to Non-Filers on EIPs (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

New Extension Deadline for Oregon Wildfire Victims

Many Oregon taxpayers are dealing with the damage caused by recent wildfires and severe storms. While victims have been forced to flee their homes beneath a smoky, orange sky, at least they have one less thing to worry about: The looming October 15 tax extension deadline.… Read more about New Extension Deadline for Oregon Wildfire Victims (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…