by | Dec 9, 2022 | Tax Tips and News

In this series, learn about a few popular Drake Tax features and navigation tools that help you save time and stay productive.

Loss of taxpayer information during the filing process due to technical difficulties is a sure way to fast-track frustration during tax season. Fortunately for Drake Tax users, today’s highlighted feature is an info life saver.

The Backup and Restore Tool at a glance

The Backup and Restore Tool does exactly what it says on the tin, and not just for tax return files: Any file can be backed up with this handy feature. You can perform manual, one-time backups or establish automatic backups to run in the background as needed.

How do I access the Backup and Restore Tool?

From the Drake Tax Home window:

- Click Tools.

- Click File Maintenance from the drop list.

- Select Backup.

The Backup and Restore window will pop up, and you can work your magic from there.

How do I make a one-time backup?

To make a one-time backup:

- Navigate to the Backup and Restore window using the instructions above.

- From the Manual One-Time Backup section of the window, choose the location where you want to back up your files.

- Click Selective Backup.

- Select Backup.

It’s that simple!

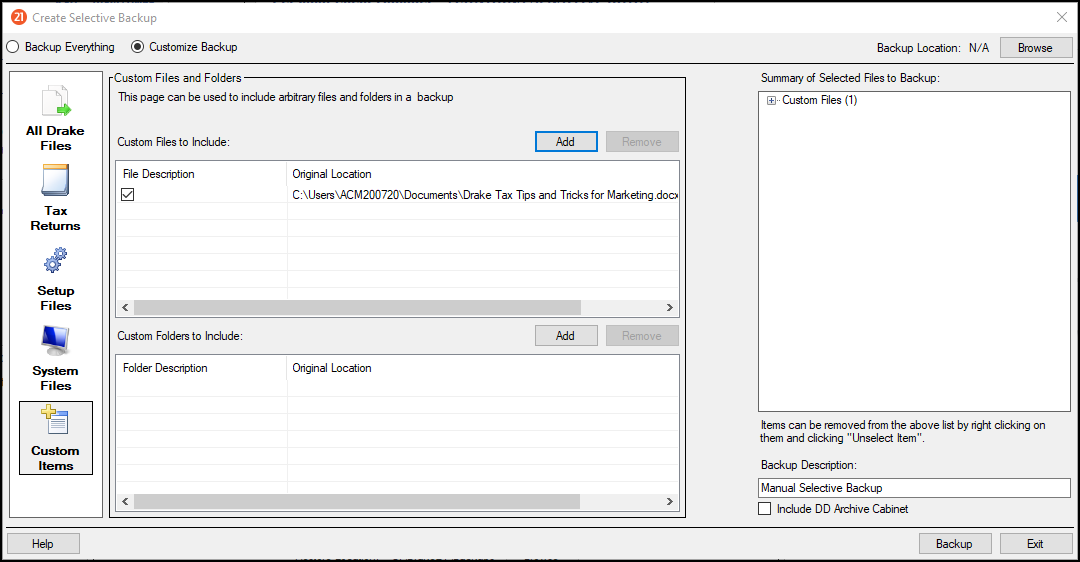

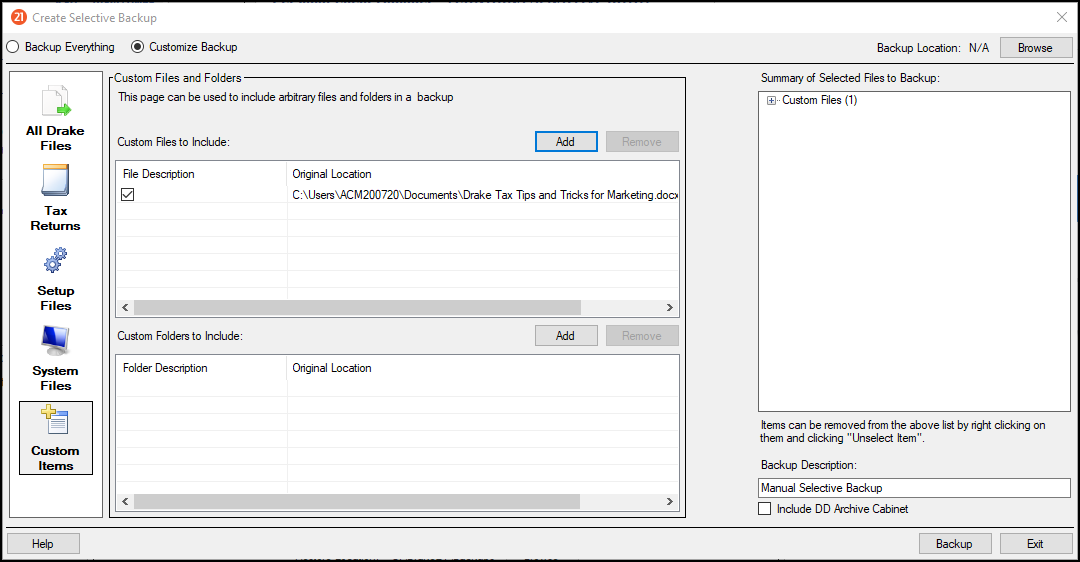

How do I make a custom backup?

To make a custom backup:

- Navigate to the Backup and Restore.

- Select Create Selective Backup.

From there, you can choose to either back up all Drake Tax files or individual ones—and these can be anything from folders to photo albums.

See how the Backup and Restore Tool saves time with a Drake Tax free trial

Ready to explore Drake Tax and the Backup and Restore Tool for yourself? Download the free trial today by clicking the button below.

– Story provided by TaxingSubjects.com

by | Nov 19, 2022 | Tax Tips and News

Don’t forget to protect your data during the holiday season (or ever)

Thanksgiving traditions are not one size fits all. Whether roasting turkey or preparing something completely different, families put their unique spin on the holiday. The Security Summit celebrates by kicking its annual National Tax Security Awareness Week on Cyber Monday, and this year marks the seventh anniversary of the event. (Their secret ingredient is practical tips for keeping taxpayer data safe.)

A collaboration between the Internal Revenue Service, state departments of revenue, and private members of the tax industry, the Security Summit has focused on helping tax professionals and taxpayers safeguard personally identifiable information (PII) since its formation in 2015. From November 28 – December 2, the Summit will share daily data security advice.

The Security Summit chooses to host its annual data security awareness event during the week of Cyber Monday, in part, to highlight the risks that tax professionals and taxpayers face during the busiest shopping season of the year. After all, identity thieves will deploy a flood of phishing scams to capitalize on the consumerism feeding frenzy. Knowing the telltale signs of scams and how to develop good cybersecurity hygiene can help protect you and your clients from identity theft.

What will the Security Summit cover during National Tax Security Awareness Week 2022?

This year, the Security Summit is sharing tips for shopping online, donating to charity, reviewing written data security plans, acquiring an Identity Protection PIN, and protecting small businesses. Here is the detailed daily itinerary shared by the IRS in a recent news release:

- Day 1 – Cyber Monday: Protect personal and financial information online

- Use security software for computers and mobile phones – and keep it updated.

- Make sure anti-virus software for computers has a feature to stop malware, and that there is a firewall enabled that can prevent intrusions.

- Use strong and unique passwords for all accounts.

- Use multi-factor authentication whenever possible.

- Shop only secure websites; look for the “https” in web addresses and the padlock icon; avoid shopping on unsecured and public Wi-Fi in places like coffee shops, malls or restaurants.

- Day 2 – Giving Tuesday: Beware of scammers using fake charities

- Individuals should never let any caller pressure them into giving a donation without allowing time for them to do some research.

- Confirm the charity is real by asking for its exact name, website and mailing address.

- Before making a donation, use the IRS Tax-Exempt Organization Search tool (TEOS) to verify it’s an IRS-recognized charity.

- Be careful about how a donation is made. After researching the charity, pay by credit card or check and not by gift card or wiring money.

- Day 3 – Tax professionals should review their security protocols

- Deploy basic security measures.

- Use multi-factor authentication to protect tax software accounts.

- Create a Virtual Private Network if working remotely.

- Create a written data security plan as required by federal law.

- Know about phishing and phone scams.

- Create data security and data theft recovery plans.

- Day 4 – Get an Identity Protection PIN

- The Identity Protection PIN or IP PIN is a six-digit code known only to the individual and the IRS. It provides another layer of protection for taxpayers’ Social Security numbers on tax returns.

- Use the Get an Identity Protection PIN (IP PIN) tool at IRS.gov/IPPIN to immediately get an IP PIN.

- Never share the IP PIN with anyone but a trusted tax provider.

- Day 5 – Businesses should watch out for tax-related scams and implement safeguards

- Learn about best security practices for small businesses.

- IRS continues protective masking of sensitive information on business transcripts.

- A Business Identity Theft Affidavit, Form 14039-B, is available for businesses to report theft to the IRS.

- Beware of various scams, especially the W-2 scam that attempts to steal employee income information.

- Check out the “Business” section on IRS’s Identity Theft Central.

The IRS also recommends tax professionals read Publication 4557, Safeguarding Taxpayer Data and Small Business Information Security: The Fundamentals. Those who are interested in sprucing up (or creating) their written information security plan (WISP) can review the sample published this year by the Security Summit.

Source: IR-2022-202

– Story provided by TaxingSubjects.com

by | Nov 3, 2022 | Tax Tips and News

Victims receive extended deadlines, deferred taxes, and more

When disaster strikes, the government’s disaster-declaration process can help victims recover from financial losses. Governors in affected states submit a major disaster area request to the president through the Federal Emergency Management Agency (FEMA); if granted, one benefit victims receive is tax relief.

Generally, this relief allows taxpayers to claim disaster-related losses on their prior-year return and provides additional time to meet filing or payment deadlines. In 2022, several states have been granted the disaster area designation. Below is an overview of federally declared disasters, their affected areas, and tax relief granted.

What recent natural disasters have been federally recognized in 2022?

Recent disasters in 2022 include Hurricane Ian, Hurricane Fiona, and severe storms in Alaska. States affected by these storms have received major disaster declarations, granting tax relief to individuals and businesses residing within affected locations.

Residents and businesses in North Carolina, South Carolina, and Florida qualify for tax relief due to Hurricane Ian, including a penalty waiver for anyone who “sells or uses dyed diesel fuel for highway use” in the state of Florida between September 28, 2022, and October 19, 2022. For more information, see our blog posts on tax relief for North Carolina, South Carolina, and Florida.

In Puerto Rico, victims of Hurricane Fiona in all municipalities qualify for tax deadline extensions. According to the IRS, residents and businesses in Puerto Rico “have until February 15, 2023, to file various federal individual and business tax returns and make tax payments.”

In Alaska, residents and businesses affected by the severe storms that cause landslides and flooding qualify for relief, too. Deadlines for paying taxes and filing individual and business returns that fall after September 15, 2022 have been extended to February 15, 2023. This relief applies to the Regional Education Attendance Areas of Bering Strait, Kashunamiut, Lower Kuskokwim, and Lower Yukon.

Other disasters include severe storms, wildfires, and flooding. For more information, see the list of affected states below.

Which states and territories contain federally declared disaster areas?

Certain counties, municipalities, and islands of the following states and territories have been granted disaster area status in 2022:

Did farmers receive disaster relief in 2022?

Farmers in 44 states and other regions who were affected by droughts in 2022 qualify for special disaster relief. According to the IRS, “farmers and ranchers in applicable regions forced to sell livestock because of drought conditions … have more time to replace their livestock and defer tax on any gains from the forced sales.” For more information, see Notice 2022-43.

Where can I learn more about disaster relief in 2022?

The IRS regularly updates the Tax Relief in Disaster Situations page on IRS.gov. You can also visit the Around the Nation page, which lists tax relief by state.

Sources: Disaster Assistance and Emergency Relief for Individuals and Businesses; IR-2022-177; IR-2022-161; IR-2022-166; Tax Relief in Disaster Situations; Notice 2022-43; Around the Nation

– Story provided by TaxingSubjects.com

by | Oct 27, 2022 | Tax Tips and News

The IRS is spreading the word

The Internal Revenue Service estimates over 9 million people who failed to file a tax year 2021 return could qualify for tax credits. This is not the first time the IRS has notified non-filers that they could be eligible for tax credits: the agency alerted 9 million taxpayers about their potential eligibility for Economic Impact Payments in September 2020.

“The special reminder letters, which will be arriving in mailboxes over the next few weeks, are being sent to people who appear to qualify for the Child Tax Credit (CTC), Recovery Rebate Credit (RRC), or Earned Income Tax Credit (EITC) but haven’t yet filed a 2021 return to claim them,” the agency explains. “The letter, printed in both English and Spanish, provides a brief overview of each of these three credits.”

For qualified filers, benefits could be substantial

Legislative packages like the American Rescue Plan Act expanded several tax credits for tax year 2021. While the IRS notes that more information on these benefits can be found in FS-2022-10, the agency also listed information in its news release:

- An expanded Child Tax Credit: Families can claim this credit, even if they received monthly advance payments during the last half of 2021. The total credit can be as much as $3,600 per child.

- A more generous Earned Income Tax Credit: The law boosted the EITC for childless workers. There are also changes that can help low- and moderate-income families with children. The credit can be as much as $1,502 for workers with no qualifying children, $3,618 for those with one child, $5,980 for those with two children, and $6,728 for those with at least three children.

- The Recovery Rebate Credit: Those who missed out on last year’s third round of Economic Impact Payments (EIP3) may be eligible to claim the RRC. Often referred to as stimulus payments, this credit can also help eligible people whose EIP3 was less than the full amount, including those who welcomed a child in 2021. The maximum credit is $1,400 for each qualifying adult, plus $1,400 for each eligible child or adult dependent.

- An increased Child and Dependent Care Credit: Families who pay for daycare so they can work or look for work can get a tax credit worth up to $4,000 for one qualifying person and $8,000 for two or more qualifying persons.

- A deduction for gifts to charity: Most tax-filers who take the standard deduction can deduct eligible cash contributions they made during 2021. Married couples filing jointly can deduct up to $600 in cash donations and individuals can deduct up to $300 in donations. In addition, itemizers who make large cash donations often qualify to deduct the full amount in 2021.

The IRS also reminds that these credits will not affect eligibility for a number of government programs:

- Supplemental Security Income

- Supplemental Nutrition Assistance Program

- Temporary Assistance for Needy Families

- Special Supplemental Nutrition Program for Women, Infants, and Children

Remember, non-filers do not have to wait on their letter to file and claim credits for which they qualify, and there is no penalty for missing the regular April 2022 tax deadline if the return has a refund due.

Source: IR-2022-178

– Story provided by TaxingSubjects.com

by | Oct 15, 2022 | Tax Tips and News

New filing deadlines for more Hurricane Ian victims

The Internal Revenue Service this week announced tax relief for victims of Hurricane Ian who reside or operate a business anywhere in North Carolina and South Carolina. Like relief granted to storm victims in Florida, the agency is delaying several federal filing and payment deadlines.

Each state has a different start date for the automatic, retroactive tax relief. In South Carolina, it affects deadlines occurring on or after September 25, 2022; in North Carolina, this period begins on September 28. In both states, the following federal deadlines are now February 15, 2023:

- October 17, 2022, individual extension filing deadline (does not apply to tax payments due April 18, 2022)

- October 17, 2022, calendar-year corporation extension filing deadline

- October 31, 2022, quarterly payroll and excise tax returns deadline

- November 15, 2022, calendar-year tax-exempt organization extension filing deadline

- January 17, 2023, quarterly estimated income tax payment deadline

- January 31, 2023, quarterly payroll and excise tax returns deadline

However, the new deadlines for penalties on payroll and excise tax deposits are different in each state. “In South Carolina, penalties on payroll and excise tax deposits due on or after September 25, 2022, and before October 11, 2022, will be abated as long as the deposits are made by October 11, 2022,” the IRS explains. “In North Carolina, penalties on payroll and excise tax deposits due on or after September 28, 2022, and before October 13, 2022, will be abated as long as the deposits are made by October 13, 2022.”

Can out-of-state relief workers get tax relief?

Those who do not reside or own businesses in the declared disaster areas can qualify for tax relief if they are currently in these locations. Relief workers affiliated with charitable and government organizations can call the IRS (866-562-5227) to receive this tax relief.

What can storm victims do about uninsured or unreimbursed losses?

The IRS also says that uninsured or unreimbursed disaster-related losses can be claimed on either the current- or prior-year tax return. When doing this, taxpayers need to include their state’s FEMA declaration number on the return:

- North Carolina: 3586-NC

- South Carolina: 3585-SC

For more information about claiming losses in this manner, read Publication 547, Casualties, Disasters, and Thefts.

Florida dyed diesel fuel penalty relief now includes all vehicles

The IRS is also expanding relief in another Hurricane Ian-ravaged state. Dyed diesel fuel is usually only allowed in equipment and vehicles exempt from the fuel excise tax. In the storm’s immediate aftermath, the IRS waived the dyed diesel fuel penalty for fuel sellers and highway emergency vehicles in Florida. This week, the agency announced it is extending that relief to all highway diesel vehicles in the state from September 28, 2022, until October 19, 2022.

To receive dyed diesel fuel penalty relief, vehicle operators must pay the 24.4-cents-per-gallon excise tax. The IRS notes it “will not impose penalties for failure to make semimonthly deposits of tax for dyed diesel fuel sold for use or used in diesel-powered vehicles on the highway in the state of Florida during the relief period.”

Read more about Florida tax relief on Taxing Subjects.

Sources: IR-2022-173, IR-2022-177

– Story provided by TaxingSubjects.com

by | Oct 15, 2022 | Tax Tips and News

While Monday, October 17 is the deadline to file tax returns for those who requested an extension earlier this year, some taxpayers may have additional time due to military service or disaster assistance. Additionally, the FBAR deadline has been extended for some due to natural disasters.

What type of military service qualifies taxpayers for additional time to file individual tax returns?

Service rendered in a combat zone by members of the military and others automatically receive additional time to file tax returns. After leaving a combat zone, taxpayers typically have 180 days to file tax returns and pay any taxes due.

Which disasters qualify taxpayers for additional time to file individual tax returns?

States and counties that have been granted emergency status due to nationally declared disasters may qualify for additional time to file.

Taxpayers have until November 15 to file various tax returns (both individual and business) if they are residents of, or operate a business in, Missouri, Kentucky, or the island of St. Croix in the U.S. Virgin Islands. Members of the Tribal Nation of the Salt River Pima Maricopa Indian Community also qualify for this deadline extension.

For those who live or operate a business in Florida, Puerto Rico, North Carolina, South Carolina, parts of Alaska and Hinds County, or Mississippi, the individual and business return deadlines have been pushed to February 15, 2023.

For more information and updates, the IRS has a designated disaster relief page available. The IRS also urges taxpayers to file as soon as possible to mitigate processing delays.

Is the October 15 FBAR deadline affected by tax relief for disasters?

Residents of Alaska, Puerto Rico, Florida, North Carolina and South Carolina residents may have a 2021 Foreign Bank and Financial Accounts (FBAR) due-date extension from October 15, 2022, to February 15, 2023.

Taxpayers who received the automatic FBAR extension in April 2022 do not need to request an extension.

For more information and updates, review published FBAR Relief Notices.

Sources: IR-2022-175; IR-2022-174

– Story provided by TaxingSubjects.com